head to www.transfs.com web site for alot more information on finances

Find the best prepaid debit cards of 2017, including low fee cards and those you can use for free. We compare features, fees, and bonuses.

Prepaid debit cards have always been a controversial topic. Some cards carry insanely high fees just for making everyday purchases. Suze Orman’s entry into the prepaid card business, the Approved Card, prompted heated debate about whether it represented a conflict of interest, given Orman’s following.

In 2010, the Kardashians announced their branded prepaid card. They received bad press due to the card’s predatory fees and lack of customer benefits. They canceled the card soon after it was announced.

Not all prepaid cards are as bad, but fees are common. You need to evaluate each offer to determine whether a prepaid card is right for you. Prepaid debit cards are the preferred tool for many parents. They can monitor their children’s spending while teaching their children how to responsibly handle money management.

The best prepaid debit cards are cards without fees, offering rewards for everyday purchases. While credit is almost everywhere in this country, many Americans do not have a credit card or bank account. They use cash for their needs. While this might be a cheaper method of paying for products and services, it isn’t always safe to carry around cash for purchases. Rather than resort to prepaid cards with high fees consider looking at some of these best prepaid debit cards available for consumers today.

The Best Prepaid Debit Cards of 2017

American Express Serve

American Express Serve

If you’re looking to avoid fees with your prepaid debit card, this choice from American Express might be the best option. You can load the card from a bank account online or by phone, or you can place your deposit in the form of cash at over 50,000 retail locations including Walmart, CVS, 7-Eleven, and Family Dollar. There is a service fee of up to $3.95 that will be added to your purchase for depositing cash.

American Express does not charge reload fees made through bank accounts and direct deposit linked to the card (in network). Cash reloads and other reload methods may carry a third party purchase or service fee. This is not a credit card, however, the card comes with many of the major benefits that all American Express cardholders receive, like roadside assistance, purchase protection, and entertainment access.

There is a $1 monthly fee but that can be waived when you have a direct deposit each month of $500 or more. No ATM withdrawal fees when you use a MoneyPass location and no online billpay fees either.

Netspend Visa Prepaid MasterCard

Netspend Visa Prepaid MasterCard

Netspend is one of the leaders in the prepaid card industry. Their strongest offering comes in the form of the Netspend Visa Prepaid MasterCard. If you’re savvy enough to know how to transfer money to and from your card without the help of a Customer Service agent, the transfers are always free, If you need help, it’s $0.50 per transfer. There is no direct deposit fee and no initial fee for getting the card.

Netspend offers three different plans to manage your prepaid card. They are as follows:

- Pay as you go – No monthly fee but a $1 charge per signature transaction and a $2 charge per pin transaction. This plan is ideal for people who plan to use their card very very little.

- FeeAdvantage Plan – $9.95 per month, all transactions included at no additional cost.

- Premier FeeAdvantage Plan – $5.00 per month if you have at least one qualifying direct deposit of $500 or more every month. The best value in terms of monthly cost if you have the direct deposit available.

Also, be careful at the ATM with this card. There is a withdrawal fee of $2.50 and a decline fee of $1 if you don’t have funds readily available.

Walmart MoneyCard® Visa® with Cash-Back Rewards

The Walmart MoneyCard® Visa® offers the best rewards program of any card on our list. For all Walmart shoppers, you stand to earn 3% cash back on every Walmart.com online purchase. 2% cash back is earned at Murphy USA and on Walmart fuel purchases and 1% cash back is earned at Walmart stores. The maximum amount of cashback you can earn is $75 each year. If you find yourself getting cut off from cash back rewards because you’ve already capped out $75 in a year … perhaps you should review your finances!

The fee structure for the Walmart MoneyCard® Visa® is fairly straightforward. There’s a $5 monthly charge and it can be waived when you load more than $1,000 on your card in the previous month. A $2.50 ATM withdrawal applies on every transaction and to get cash from your card at a Walmart location is free of charge. There is no charge to receive the initial card, no charge to make daily purchases and a $3 fee if you require a replacement card.

American Express Serve® Cash Back

American Express Serve® Cash Back

If cash back is your game, the American Express Serve Cash Back provides a great opportunity. Every time you shop at a store or online, you’ll earn 1% cash back. Cash back is added immediately after you make your payment and available for redemption on your next purchase, at anytime. There is no annual cap on the amount of cash back you can earn and it never expires, so long as your account remains open and in good standing.

Now let’s talk fees. The initial card price is up to $3.95 if buying at a retail location. There is a $5.95 monthly fee unless you live in TX, VT or NY (no fee in those states). No direct deposit fee, no fee to add money from a bank account but up to a $3.95 fee to add cash at a retailer. Depending on the ATM you use, there could be up to a $2.50 ATM fee. No ATM fees when using a MoneyPass location. Last but not least, if you’re looking to take cash out of your American Express Serve Cash Back, up to a $9.49 fee applies.

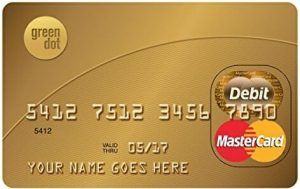

Green Dot® Prepaid MasterCard®

Green Dot® Prepaid MasterCard®

This is a card with a simple fee plan. Cardholders will not have to pay a monthly fee as long as they deposit at least $1,000 onto the card monthly or make 30 qualifying purchases posted to your account monthly. If these conditions are not met, the monthly fee is $7.95. There are fees for initial purchase, which varies by retailer, of up to $4.95. Reload fees also vary by retailer and is currently up to $4.95.

Green Dot is an extremely convenient but expensive prepaid option. In addition to using the card for everyday purchases, you have the ability to write checks using your account. The limit per check is $3,000 and it’s only good for 90 days. In addition, The Green Dot® Prepaid MasterCard® offers free online mobile bill pay and NO fee for an ACH transfer. As always, direct deposit is FREE.

Try a Checking / Savings Account Instead

Chime Visa® Debit Card

Chime Visa® Debit Card

Prepaid cards can certainly make life easier, but they can also make life more expensive. If you’re in the market for a prepaid card, you may want to consider opening a savings account with Chime. The Chime Visa Debit Card can be used anywhere Visa is accepted. There’s no monthly fee to worry about, no card fee, and no fees for making day to day purchases. ATM’s in the Money Pass network are also free to use (there are over 24,000 of them nationwide)

On the savings account side, every time you use your Chime card to make a purchase, they round up the dollar amount and deposit the change into your Chime Savings Account. Setting up direct deposit is easy and there are no fees to transfer money in and out of your account. Coolest of all, Chime is willing to start you off with a free $5 after you first direct deposit.

You can also have a look at our best savings and checking account promos. All of the checking accounts listed can also provide you a debit card to make purchases, but be aware of each bank’s monthly fees and/or requirements for waiving the fee.

Final Thoughts

As you can see, the prepaid debit card industry is mired in fees. If you believe a prepaid debit card is right for you, tread carefully. Read the terms and conditions and know the fees. Even the best prepaid debit card can end up costing more money than you are prepared to spend. There are many other debit cards I’m not including in this list at all because they are best avoided. Using a prepaid debit card can help a responsible person who does not qualify for a credit card handle their expenses, but it can also be a recipe for disaster.