head to www.transfs.com web-site for alot more information and facts on money

You can get your credit score for free if you know where to look. Here are eight ways to check your FICO score without paying a dime.

Many consumers know that they can get a free annual credit report from each of the three credit reporting bureaus: Equifax, Experian, and TransUnion. But this report only shows your credit report, not your actual credit score.

When you go to get your free annual credit report, the credit bureau will likely ask if you want your numerical credit score. There will almost always be a fee involved with providing this to you.

It is useful to know this number, especially if you’re trying to increase it or plan to apply for credit. But did you know that you don’t actually have to pay for your credit score? More and more websites these days are offering them for free.

Before we dive into the details, let’s talk about one quick thing: you have more than one credit score. It’s confusing but true!

There are several different credit scoring algorithms, created by companies like the Fair Isaacs Corporation (FICO). These models each have a slightly different emphasis. They’re meant to give lenders the most relevant score for the type of loan you’re trying to obtain. And each of these models can be applied to each of your three credit reports, which typically contain slightly different information.

So if you look at your score through more than one of these free options, you’ll likely see slightly different numbers. That’s normal. You’re just getting an idea of what lenders will likely see when they pull your credit report and score.

Here are our eight favorites:

1. Credit Karma

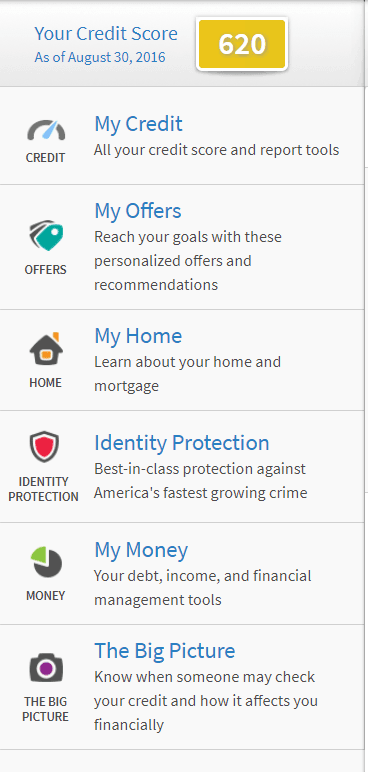

This website specializes in providing consumers with a free credit score, updated monthly. Credit Karma is one of the more valuable options on this list. Most free credit score options are based on a credit file from just one of the three major reporting bureaus. Credit Karma offers scores based on both your TransUnion and your Equifax reports.

The free dashboard will tell you if your scores have changed recently. It will also cover the factors that influence your credit score, including your payment history, credit card utilization, and more.

Unlike many of the free credit scores named here, Credit Karma’s will give you access to your credit report details, including current credit card balances, derogatory information, and more.

Credit Karma is also helpful if you’re shopping for a credit card, as it will recommend cards based on your current credit score.

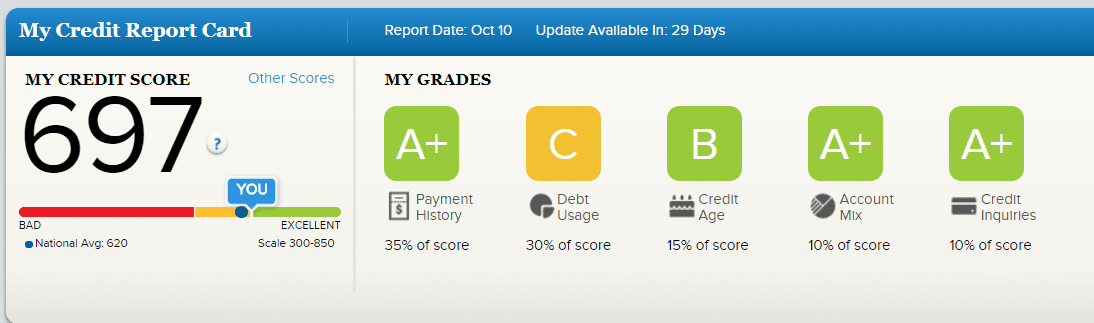

2. Credit Sesame

Answer a few basic questions, and Credit Sesame will give you access to your TransUnion credit score for free. If you’d like to have all three credit bureau scores, you can pay $15.95 per month. You can also opt to pay $19.95 per month for access to all three bureau scores, along with credit monitoring and ID protection.

One interesting feature of Credit Sesame is its borrowing power estimate. It tells you how to apply for different credit cards that it recommends, as well as loans to borrow funds you may need.

Credit Sesame grades you on each aspect of your credit score, including payment history, credit usage, and account mix. It’ll give you details on problems in each of these areas, as well as ideas for how to improve your credit score. Quizzle also rates your debt-to-income ratio, based on self-reported income information. This isn’t included in your credit report, but is useful to know if you’re planning to apply for a major loan, like a mortgage.

3. Quizzle

Quizzle’s score is based on the VantageScore model, which may look different from models based on the FICO scoring model. It’s still an accurate representation of your creditworthiness, though it may not be exactly what your lenders see if they prefer to pull a FICO score.

Like the other options here, Quizzle’s score offers a variety of tools. It includes a credit summary that shows all of your different accounts and their balances. It also offers a complete overview, including credit utilization, available credit, length of credit history, and average age of accounts.

Like the other options here, Quizzle’s score offers a variety of tools. It includes a credit summary that shows all of your different accounts and their balances. It also offers a complete overview, including credit utilization, available credit, length of credit history, and average age of accounts.

Quizzle’s “trending” feature allows you to track your progress in a variety of areas related to your credit score, including your actual score, available credit, balances, and more. This can help you see how you’re progressing with raising your credit score month over month.

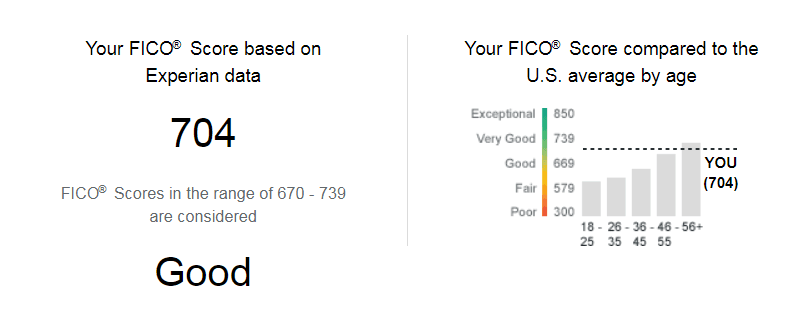

4. Discover Scorecard

Even if you’re not a Discover customer, you can sign up for a free Scorecard account. This option will provide you with your Experian FICO score. You’ll get your actual numerical score, as well as a grade that compares your score to the rest of the U.S.

Discover’s Scorecard will give you access to the various aspects of your score, including your open accounts, length of credit history, credit utilization, and missed payments. It’ll tell you what’s helping and what, if anything, is hurting your score. Discover offers several financial products, including personal loans. The scorecard will tell you if you might qualify for a lower-interest personal loan, which you could use to refinance higher-interest debt.

5. LendingTree

Sign up for an account with LendingTree, and you’ll get access to your free credit score from TransUnion. Similar to the other services, LendingTree will track your score over time, and will grade each aspect of your score. This includes negative marks on the report and your available credit. It’ll also give you specific ways to improve your credit.

Besides giving you recommendations for credit cards that fit your score, LendingTree will give you offers for personal loans and refinancing options. One of the interesting things about LendingTree is that it’ll give you specific ways to save, based on your current situation. For instance, it may tell you that you can refinance a specific personal loan to a lower payment. It’s a useful tool if you’re hoping to refinance your debts to pay them off faster.

6. Credit.com

This service is interesting because credit.com will show you both your FICO score and your VantageScore 3.0. This way, you can get some perspective on how they’re different. It’ll give you grades on the various areas of your credit score, including how you stack up to the average American.

Credit.com will also create a customized plan for you to reach a higher credit score, and it’ll estimate how high your score could go if you followed the plan. For instance, your plan might tell you to have no late payments for a certain number of months and pay off an extra $X in debt each month. Then, it’ll tell you approximately how high your credit score should be at the end of that period.

7. Your Credit Card Company

More credit card companies are now jumping on the free credit score bandwagon. Your statement or online account may come with access to a free credit score. Some card companies, like Capital One, even offer a credit simulator tool, where you can “try out” different credit decisions to see how they could impact your score.

Credit card companies currently offering their customers free credit scores include Discover, Citi, Chase, Bank of America, Barclaycard, Commerce Bank, American Express, Capital One, First Bankcard, USAA Bank, US Bank, and the Walmart Credit Card.

8. Apply for Credit

As of 2011, lenders are required to provide customers or potential customers with a copy of the credit score the lender used, even if the customer is rejected for the loan or line of credit.

Applying for credit can ding your score. If you’re going to do it anyway, be sure the lender provides you with a copy of the score used.

Keeping track of your own credit score through your credit card company or these free methods will not harm your score, and may even help you bring it up more quickly. The only option listed here that will impact your score is applying for credit. So before you do that, use a free option to pull your credit score. That way, you’re more likely to apply only for credit for which you’re likely to be approved.